[ad_1]

The Inflation Reduction Act, the major climate bill, was signed August 16, changing the availability of electric vehicle tax credits. The law is still in the process of being implemented, so tax credit qualifications continue to change as the IRS offers further guidance. This post intends to break down the current eligibility requirements for the EV tax credit as they continue to be updated.

The Inflation Reduction Act focused on expanding availability of tax credits (including allowing plug-in hybrid models to access the full credit), bringing more EV and battery production to the US, and ensuring that credits are not all taken up by luxury cars purchased by members of the upper income brackets.

But the phase-in times of various provisions have created a lot of confusion in the EV community about which vehicles will qualify and when.

One of those requirements, which went into place on August 16, is that vehicles must be assembled in North America to qualify for EV purchase tax credits. The Department of Energy’s Alternative Fuels Data Center maintains a list of vehicles with final assembly in North America. You can verify your car’s final assembly location by using the VIN decoder at the bottom of this page.

However, the Treasury has suggested that cars assembled outside North America may qualify for the EV tax credit through the commercial vehicle tax credit, assuming those cars are leased not purchased. So dealerships can still file for tax credits on leased vehicles, and presumably pass this on in the form of lower lease payments.

The tax credit is limited to cars under $55K MSRP and under $80K MSRP for trucks and SUVs. The IRS updated their guidelines on February 3, qualifying more EVs as SUVs, increasing the credit limit for the Model Y, Mach-E, Lyriq, and ID4. MSRP does not mean the price you paid for the car, but the manufacturer’s suggested price, which will be listed on the window sticker.

Below is the IRS’ list of electric vehicles and plug-in hybrids made by qualified manufacturers, sorted by manufacturer. Some manufacturers have submitted paperwork to become a “qualified manufacturer” but have not yet submitted a list of eligible vehicles, so their entries will be empty until they submit that information to the IRS.

We’ve added links where possible so you can search local dealer inventory for the car you’re looking for. We’ll be updating this list as the IRS adds more cars to it.

Audi

BMW

Ford (includes Lincoln)

| Model Year | Vehicle Description | MSRP Limit |

| 2022, 2023 | Ford Escape Plug-In Hybrid | $80,000 |

| 2022, 2023 | Ford E-Transit Van | $80,000 |

| 2022, 2023 | Ford F-150 Lightning | $80,000 |

| 2022, 2023 | Ford Mustang MACH E | $80,000 |

| 2022, 2023 | Lincoln Aviator Grand Touring (PHEV model) | $80,000 |

| 2022, 2023 | Lincoln Corsair Grand Touring (PHEV model) | $80,000 |

General Motors (includes GMC, Chevy, Buick, Cadillac)

Honda

*Honda has not yet submitted a list of models to the IRS.

Hyundai (including Genesis)

Jaguar Land Rover

*Jaguar Land Rover has not yet submitted a list of models to the IRS.

Kia

*Kia has not yet submitted a list of models to the IRS.

Mazda

*Mazda has not yet submitted a list of models to the IRS.

Mercedes-Benz

*Mercedes has not yet submitted a list of models to the IRS.

Mitsubishi

*Mitsubishi has not yet submitted a list of models to the IRS.

Nissan

| Model Year | Vehicle Description | MSRP Limit |

| 2021, 2022, 2023 | Nissan Leaf S | $55,000 |

| 2021, 2022 | Nissan Leaf S Plus | $55,000 |

| 2021, 2022 | Nissan Leaf SL Plus | $55,000 |

| 2021, 2022 | Nissan Leaf SV | $55,000 |

| 2021, 2022, 2023 | Nissan Leaf SV Plus | $55,000 |

Polestar

*Polestar has not yet submitted a list of models to the IRS.

Porsche

*Porsche has not yet submitted a list of models to the IRS.

Proterra

*Proterra has not yet submitted a list of models to the IRS.

Rivian

Stellantis (includes Chrysler, Jeep)

Subaru

*Subaru has not yet submitted a list of models to the IRS.

Tesla

| Model Year | Vehicle Description | MSRP Limit |

| 2022, 2023 | Tesla Model 3 Rear Wheel Drive (Order here) | $55,000 |

| 2022, 2023 | Tesla Model 3 Long Range (Order here) | $55,000 |

| 2022, 2023 | Tesla Model 3 Performance (Order here) | $55,000 |

| 2022, 2023 | Tesla Model Y All-Wheel Drive (Order here) | $80,000 |

| 2022, 2023 | Tesla Model Y Long Range (Order here) | $80,000 |

| 2022, 2023 | Tesla Model Y Performance (Order here) | $80,000 |

Toyota

*Toyota has not yet submitted a list of models to the IRS.

Volkswagen

Volvo

Note that this list will change with time. We can’t guarantee that any given customer will get access to the credit and are providing the best information we can. Manufacturers can contact the IRS to be added to this list.

Further, some models may change production mid-year or are based on specific trim levels, so you should confirm that your individual vehicle was assembled in a North American plant if you are taking advantage of the purchase credit. The AFDC recommends that you use their VIN decoder at the bottom of this page to confirm that your car was assembled in North America. If you are leasing your car, the dealership will be responsible for doing the paperwork to claim the commercial credit.

The IRS has released a page explaining section 30D of the Internal Revenue Code, which is the section that contains the EV tax credit. This includes a description of what a “written binding contract” is, which allowed EV buyers to take the “old” credit if they signed a purchase contract before the day the IRA was signed.

The tax credit relies on several definitions, some of which the IRS defines here. These are mostly self-explanatory (final assembly, North America, MSRP, etc).

Income caps have also been put into place, meaning those earning over $150K ($225K head of household, $300K filing jointly) will not be able to take advantage of the EV tax credit.

Other requirements which have not yet phased in include battery material and critical mineral sourcing guidelines that will be developed by the IRS. The IRS was supposed to issue those guidelines by the end of 2022, but pushed the timeline back and will now issue them by the end of March. This means there may be a window from January 1 until March 2023 where some cars, like the Chevy Bolt, qualify for a $7,500 credit, rather than the anticipated $3,750. We will update this post with more information when available.

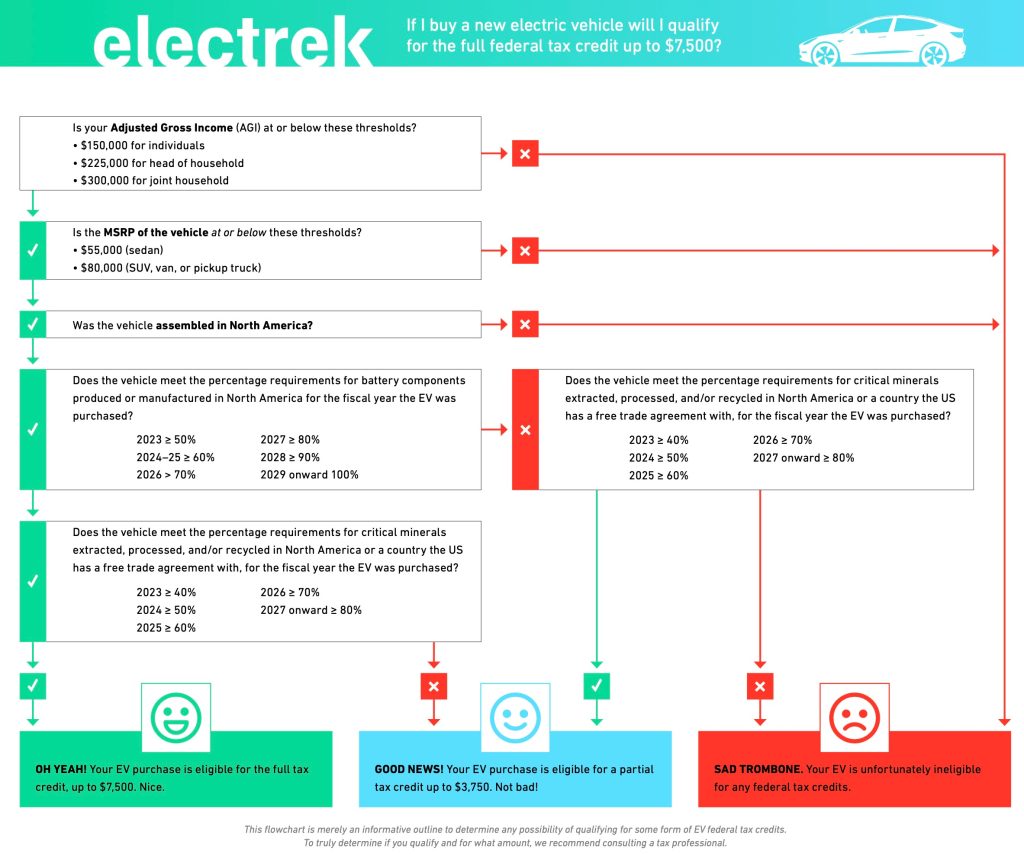

Here is a handy flowchart detailing which cars will qualify for the tax credit, assuming there are no surprises in the IRS’ battery guidance:

There’s also a provision to allow buyers to take advantage of the EV tax credit upfront at the point of sale, but that doesn’t go into place until 2024. The $4,000 used vehicle credit starts in 2023, as does a commercial vehicle credit.

Frequently Asked Questions on the EV tax credit

Cars assembled in North America can qualify for up to $7,500 in federal EV tax credits – $3,750 if the battery components were built in North America, and $3,750 if “critical minerals” in the battery are sourced from the US or countries the US has free trade agreements with. Cars assembled outside of North America can still qualify for a commercial vehicle tax credit, assuming they are leased, not purchased.

It has already started, though various provisions will phase in over the next months and years. Cars assembled outside of NA, or above the income or price caps, already do not qualify for tax credits. Battery component restrictions go into effect some time in March. An upfront point-of-sale credit will phase in in 2024.

North American-assembled cars which fall under the $55k/$80k price cap qualify for the EV tax credit, though in March this will start depending on where their battery components and critical minerals were sourced. While cars assembled outside NA don’t qualify for the purchase credit, leased vehicles can still take advantage of the commercial EV tax credit.

The Inflation Reduction Act includes a provision to make credits available at the point of sale, but it doesn’t go into effect until 2024.

Per the new IRS fact sheet on the Inflation Reduction Act, leased vehicles can qualify for the commercial vehicle tax credit, which doesn’t require North American assembly. If you lease a foreign-assembled vehicle from a dealership, the dealership should qualify for the EV tax credit, which they can then pass on to the buyer.

Yes, there is a tax credit available for used EV purchases, but it is much more limited than the new vehicle tax credit. To qualify, you must buy an EV for under $25k from a licensed dealer, and the credit will be in the amount of 30% of the price of the vehicle, up to $4,000 maximum.

The tax credits are nonrefundable and can’t be applied to future tax years, so if your total tax liability is not high enough, you won’t be able to take full advantage of the credit. It is possible that in the future, when the credit is made available upfront at the point of sale in 2024, low-income buyers will be able to transfer the credit to the dealership and thus take advantage of the full amount, despite low tax liability. Consult a tax professional for more information about your specific situation.

FTC: We use income earning auto affiliate links. More.

[ad_2]

Source link