[ad_1]

Electric vehicle (EV) king Tesla (NASDAQ:TSLA) is doing it again. This time, Tesla is bumping up prices on select models in China. Prices of the long-range versions of Model 3 and Model Y are increasing by RMB 1,500 and RMB 2,500, respectively, effective today. Both of these models are built in-house at China’s Gigafactory in Shanghai.

With the price increase, Tesla’s long-range Model 3’s basic version will now cost RMB 297,400. Similarly, the long-range Model Y’s basic version will become more expensive, costing RMB 302,400. Moreover, the prices of standard-range versions of both models are also expected to shoot up soon. The speculation is meant to push customers to buy the EVs in anticipation of increased prices.

As per the China Passenger Car Association (CPCA), Tesla delivered 72,115 China-made EVs in October, marginally higher than in October 2022 but significantly lower than those sold in September 2023.

Is Tesla a Buy or Sell?

On November 8, HSBC analyst Mike Tyndall initiated coverage of TSLA with a Sell rating and price target of $146 (34.3% downside potential). Tyndall is discouraged by the fact that Tesla is aiming to focus more on “robots, autonomous vehicles, energy storage, and super-computers” in the future. Although Tesla’s EVs drive most of the revenues currently, the prospects remain bleak, he added.

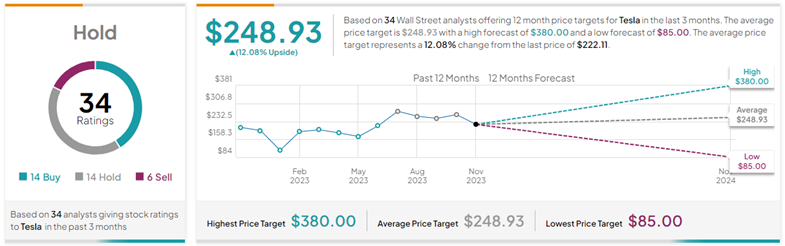

Other analysts, too, are cautious about Tesla’s stock trajectory. On TipRanks, TSLA has a Hold consensus rating based on 14 Buys, 14 Holds, and six Sell ratings. Also, the average Tesla price forecast of $248.93 implies 12.1% upside potential from current levels. Year-to-date, TSLA stock has exploded by 105.5%.

[ad_2]

Source link