[ad_1]

A credit score is a number, usually between 300 and 850, that provides a snapshot of a consumer’s creditworthiness. Lenders use these scores to decide whether a potential borrower is qualified for a loan, and in many cases, to set the interest rate and other terms. By tracking and keeping a score in the good range or better, consumers may qualify for the best rewards credit cards and other loans.

What is a good credit score?

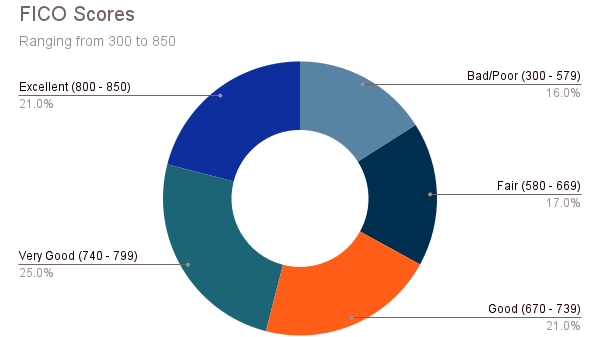

Two companies control the market for credit scores: FICO (opens in new tab) and VantageScore (opens in new tab). FICO considers a score of 670 to 739 as good, while VantageScore rates a score of 661 to 780 as good. FICO (opens in new tab) boasts that 90% of top lenders rely on their scores, and consumers generally need to focus on their FICO score first. Credit card companies, however, will often look at both FICO and VantageScores.

How do you measure up to other borrowers?

The average FICO score in the US was 716 in 2022. And as the chart below demonstrates, about 67% of US consumers had a good credit score, or better, according to Experian (opens in new tab). About 20% of US adults are “credit invisible” or “unscorable,” meaning they have no or little credit history, and as a result, no credit score.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more – straight to your e-mail.

Profit and prosper with the best of expert advice – straight to your e-mail.

(Image credit: Experian)

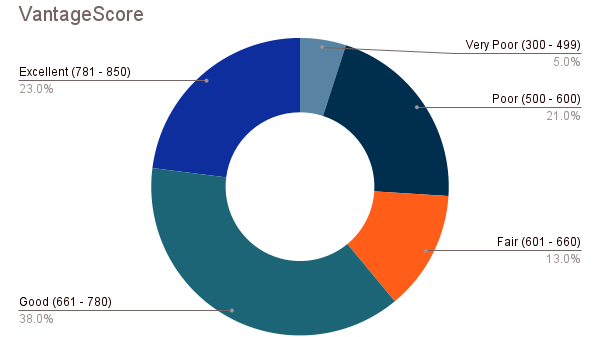

The latest versions of the VantageScore also use a 300 to 850 scale, with about 61% of Americans having a Good VantageScore or better.

(Image credit: Experian)

How to check your credit score?

Many banks and credit card issuers offer free FICO scores every month for customers, so take a look at your account online. Experian, one of the three major credit bureaus, also supplies a free score and credit report at www.freecreditscore.com (opens in new tab). To check your VantageScore, sign up for Chase Bank’s free credit monitory service, Credit Journey (opens in new tab), or see other programs offered by VantageScore (opens in new tab) partners.

Checking your credit score using FICO or Vantage, called a “soft pull,” will not harm your credit score. But when you apply for a credit card or loan, the lender will conduct a “hard pull,” running a report that will temporarily lower your credit score. That is why knowing your credit score is so important before applying for a loan or card. If you have applied for a few credit cards and been rejected, for example, your credit score will be lower and it will be even harder to qualify for a new card until some time has passed and your credit score has recovered.

Why do I have more than one credit score?

There are myriad factors that determine your credit score. FICO and VantageScore base their algorithms on the same underlying data but assign a different weight to the same criteria. FICO and VantageScore get these data in turn from three credit bureaus that track your credit activity: Equifax, Experian and TransUnion. As a result, you may see slightly different scores based on whether data was pulled from all three bureaus or just one.

Credit bureau and scoring algorithms also have different versions; sometimes a lender will use a score drawn from the latest version or rely on an older, even years-old version of the algorithm. For example, after a 2022 study by the Consumer Financial Protection Bureau (CFPB) found that the credit scores of one in five Americans are lowered by medical debt (opens in new tab), the three bureaus announced that they would change their credit reports to exclude some forms of medical debt.

What affects my credit score?

Across all of the credit reporting and scoring services, these are the most important factors that go into your credit score.

Payment history is based on your record of paying bills on time and is the most important criterion for determining your score. Late or missed payments can significantly lower your credit score.

Credit utilization reflects the amount of credit you are using relative to your credit limit. Using more than about 30% of your available credit will likely lower your score.

Length of credit history refers to the amount of time you have had your accounts. A long credit history demonstrates that you have had plenty of practice managing debt payments.

Credit mix refers to the types of credit you rely on. Having both revolving (mortgages and car loans) and installment (credit cards) loans will increase your score since it shows you can handle different types of payments and terms.

New credit accounts or applications can lower your credit score by generating a “hard pull” and by lowering your average length of credit history.

Tips for increasing and protecting your credit score

Pay your bills on time and if possible, pay the full amount due each month.

Keep your credit utilization low, ideally below 30% of your credit limit

Don’t close old credit card accounts. If you are thinking of closing a credit card that you’ve had for many years in order to avoid an annual fee, consider asking the card issuer to roll the account onto a similar card with no fee. Even if you never use the card, you’ll maintain your long credit history.

Check your credit report and credit score periodically. Keep an eye out for incorrect information or fraudulent activity, and know how to fix your credit report if you find errors.

Once you get a good, or even excellent credit score, don’t rest on your laurels. Good credit hygiene, like keeping up with all of your credit card or loan payments, can help you qualify for choice loans in the future.

[ad_2]

Source link