[ad_1]

45 Mins Ago

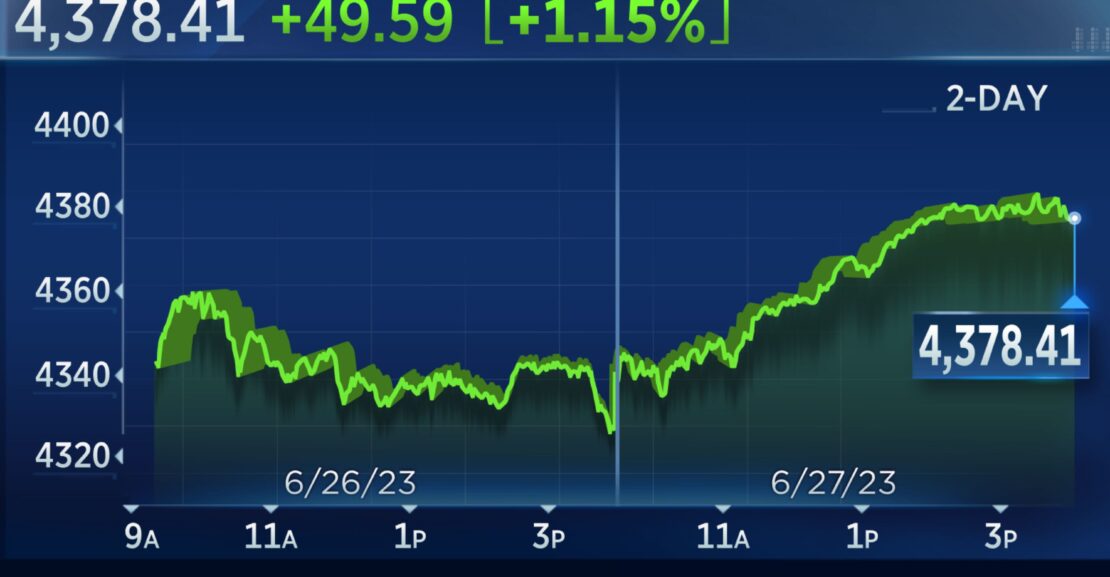

Stocks finish higher, Nasdaq jumps more than 1.6%

Stocks wrapped up Tuesday’s session on a positive note.

The Dow Jones Industrial Average climbed about 212.03 points, or 0.63%, to end at 33,926.74. The S&P 500 advanced 1.15% to finish at 4,378.41, while the Nasdaq Composite surged 1.65% to settle at 13,555.67.

— Samantha Subin

An Hour Ago

Bank of America reiterates Roblox as a buy, calls platform an ‘early leader’ in bringing advertisers to the metaverse

Roblox is leading the charge in bringing immersive advertising to the metaverse, and that could usher in some major benefits for investors, according to Bank of America.

“We think their validation of RBLX gives mainstream brands, including agencies, permission to enter 3D advertising supporting ad spend & investment in talent,” wrote Omar Dessouky in a Monday note, reiterating his buy rating on shares.

The analyst called the gaming platform an “early leader” in developing the tools to lure advertisers, saying that a successful foray could lead to “upside surprises” for long-term bookings expectations and EBITDA margins.

“We see an extended runway for mid-20% growth as users worldwide adopt Roblox’s Metaverse, in a virtuous cycle that will draw developers, brands, and merchants to the platform,” Dessouky said.

The stock surged 7% on Tuesday.

— Samantha Subin

An Hour Ago

Regeneron slides after eye disease medication hits FDA roadblock

Shares of Regeneron fell nearly 8% in afternoon trading after the biotech company announced that the Food and Drug Administration had declined to approve the application for an 8 milligram dose of a medication used to treat a degenerative eye disease.

The company said that the FDA issued a complete response letter and did not request further data or clinical trials. Regeneron said in the release that the decision was “solely due to an ongoing review of inspection findings at a third-party filler” and that it will continue working with the FDA and third-party to try to resolve the issue.

The stock was down less than 2% on the day before trading was briefly halted for the news release.

See Chart…

Shares of Regeneron fell sharply in afternoon trading.

An Hour Ago

Advancers lead decliners 3-1 at NYSE

Roughly three stocks rose Tuesday for every decliner at the New York Stock Exchange, as Wall Street tried to regain footing after last week’s declines. More than 2,100 NYSE-listed names traded higher on the day, while just 671 were down.

— Fred Imbert

An Hour Ago

Stocks broadly higher in final hour

Stocks retained strong gains as the final hour of trading kicked off Tuesday.

The Dow Jones Industrial Average climbed about 230 points, or 0.7%, while the S&P 500 rose 1.1%. The Nasdaq Composite advanced 1.7%, boosted by popular technology names.

— Samantha Subin

2 Hours Ago

Alternative data shows labor market is cooling, Barclays says

The labor market may be cooling, according to alternative data reviewed by Barclays.

“Alternative data from US employee profiles send cautious warning signals that the US labor market is not as strong as it was last year, as the total tally of employees from our alternative data appears to have peaked in Jan’23, and has declined slowly since,” read a Tuesday note from the firm’s Investment Sciences and Data Science teams.

“In fact, net inflows for various job categories have turned negative for a few categories and have been growing less strongly in others,” it continued.

The Wall Street firm said the data shows “reluctance” from companies to hire or fire workers, while workers are unwilling to quit their current jobs.

— Sarah Min

2 Hours Ago

Airline, travel stocks soar as Delta boosts outlook

3 Hours Ago

Bank of America says ‘bifurcated’ market risks continue until Dow breaks above November peak

Risks of a bifurcated market linger for U.S. equities until the Dow Jones Industrial Average can break above its November peak, according to Bank of America strategist Stephen Suttmeier.

“The Dow Industrials and Dow Transports have confirmed the tactical US equity market rally from March, but the Dow Theory has yet to confirm a primary bull market from late 2022,” he wrote. “The Dow Industrials need to break out above the 11/30/2022 peak at 34,590, while the Dow Transports need to clear the 2/2/2023 peak at 15,641 to confirm a ‘bull market’ based on Dow Theory.”

The Dow theory refers to the idea that when one of the Dow’s underlying averages breaks above an important previous high, the broader index will likely follow.

— Samantha Subin

3 Hours Ago

Investors ‘can’t ignore’ these online auto retailers, JPMorgan says

JPMorgan analyst Rajat Gupta initiated coverage of CarGurus and Cars.com at overweight on Tuesday.

“We believe the auto marketplace sector is a relatively safe place to hide in the current macro backdrop given undemanding valuation and some cyclical support as new car inventory builds and both dealers and consumers look to get increasingly efficient in buying and selling vehicles,” Gupta said in a note to clients.

The companies’ asset-light structure and flexible business models are points in their favor, Gupta said, but he did caution that a weakening consumer credit backdrop is a risk for the stocks.

Both stocks were up more than 6% in midday trading.

— Jesse Pound

3 Hours Ago

Take a closer look at the state of the consumer, Wolfe Research says

Wolfe Research says investors should keep an eye on the state of the consumer, as it will be even more important as traders head into the second half.

“We expect the U.S. consumer to be the #1 driver of the economic outlook and sector rotation in the months ahead,” Chris Senyek wrote Tuesday.

“At the low-end, we see disappointments into fading ‘excess savings,’ tightening credit, lower government transfers, and a restart of student loan repayments. Our sense is that the higher-end, driven by net worth, will be more resilient,” Senyek added.

— Sarah Min

4 Hours Ago

Prepare for a ‘challenging backdrop’ in the second half, JPMorgan says

Despite a strong start to the year, JPMorgan’s Marko Kolanovic is bracing for some difficulty heading into the second half.

“We expect a more challenging backdrop for stocks in H2 and believe risk-reward remains unattractive, given the decelerating economy and a likely recession starting in 4Q23/1Q24, softening consumer trends … and the significant re-rating of stocks so far this year,” he wrote in a note to clients late Monday.

Given this setup, Kolanovic expects moderating growth in the second half, with stubborn inflation forcing central banks to retain their restrictive stance and potentially tighten further.

“Market volatility is unusually low given the high interest rates and risk of recession, which in our view is largely technical in nature, driven by short-dated option selling that creates a virtuous cycle between long gamma hedging and systematic strategy re-leveraging,” he said.

— Samantha Subin

4 Hours Ago

Lordstown Motors, Delta Air Lines among Tuesday’s biggest midday movers

These are the stocks making the biggest moves during midday trading:

Lordstown Motors — The embattled electric truck maker dropped more than 30% after filling for bankruptcy. Lordstown is also suing Taiwanese manufacturer Foxconn over a $170 million funding deal.

Walgreens Boots Alliance — Shares tumbled nearly 9% after the retail pharmacy chain lowered its full-year earnings guidance to $4 to $4.05 per share from its previous forecast of $4.45 to $4.65 per share. Walgreens also reported adjusted earnings per share for its fiscal third quarter of $1, missing a Refinitiv forecast of $1.07.

Delta Air Lines — Shares rose 3.3% after the airline put its forecast for full-year earnings at $6 per share, at the high end end of the previously set range. Delta said it has been helped by strong demand and customers opting for more expensive fare classes.

Read more on Tuesday’s biggest movers here.

— Alex Harring

4 Hours Ago

Technology, consumer discretionary stocks among S&P 500 gainers

Information technology and consumer discretionary stocks were among the biggest winners in the S&P 500 during midday trading.

Gains from the likes of technology giants Nvidia, Apple, Amazon, Microsoft and Tesla lifted both sectors more than 1% each. Travel stocks Expedia, Carnival, Booking Holdings and Norwegian Cruise Line also gained, boosting the consumer discretionary sector 1.4%.

The industrials sector rose 1%, benefitting from surging airline stocks. Delta, American Airlines and United jumped more than 4% each. Generac and Old Dominion soared more than 8% and 6%, respectively.

Just two sectors — utilities and health care — dipped into negative territory. A sell off in shares of Illumina, Amgen, CVS Health and Danaher following a disappointing quarter and guidance from Walgreens Boots Alliance contributed to the 0.5% loss in health care.

— Samantha Subin

5 Hours Ago

Housing stocks get boost from strong sales reports

Housing-related stocks helped propel the market higher following better than expected reports on sales and prices.

The SPDR S&P Homebuilders ETF surged about 2.4% in morning trading, following the Case/Shiller report showing that prices held up in April, while the Commerce Department reported an unexpected boom in new home sales in May.

Home Depot led gainers on the Dow, rising 1.9% while the S&P real estate sector rose 0.9%, boosted by gains from Weyerhaeuser Company and CBRE Group.

—Jeff Cox

5 Hours Ago

Yield performance surrounding a recession looks ‘inconsistent,’ Canaccord Genuity says

As recession fears mount on Wall Street, Canaccord Genuity took a look at how Treasury yields have previously performed in the six months before and after a downturn.

“We found the results to be inconsistent, with yields bottoming during the recession half of the time (1973, 1980, 2001, and 2007),” wrote analyst Tony Dwyer, adding that most instances — with the exception of 2007 — saw yields decline after the S&P 500 hit its low.

“If October proves to be ‘the’ low, it would be the first time it occurred (1) before a peak in the two-year (hit new high in March) and (2) before the recession even began,” he said.

— Samantha Subin

5 Hours Ago

Leveraged bitcoin futures ETF to launch Tuesday

A new leveraged bitcoin futures fund is hitting the market just as excitement building about spot bitcoin funds potentially getting approval in the U.S.

The Volatility Shares 2x Bitcoin Strategy ETF (BITX) is set to launch on Tuesday. There are already several bitcoin futures funds on the market, including the $1 billion ProShares Bitcoin Strategy ETF (BITO), but BITX will be the first leveraged ETF in the space.

Read more about the fund on CNBC Pro.

— Jesse Pound

6 Hours Ago

The Federal Reserve could trigger a recession in the early months of 2024, Seth Klarman says

A recession could hit the U.S. economy early next year, according to Baupost Group chief executive officer Seth Klarman.

“The goal of the Fed is to reduce the heat in the economy, and one way to do that is to trigger some kind of recession,” Klarman told CNBC’s “Squawk Box” Tuesday. “It’s been slow developing, [and] some people think that the excess cash in people’s pockets will start to run out around year-end, so maybe it’s an early 2024 event”

— Brian Evans

6 Hours Ago

Consumer confidence improved more than anticipated in June

The outlook from consumers brightened more than expected in June even with an expected recession on the horizon, The Conference Board reported Tuesday.

Consumer confidence for the month rose to an index value of 109.7, up from 102.5 in May and better than the Dow Jones estimate for 104. That was the highest reading since January 2022.

New questions focused on household finance showed 30% of families expecting their situations to improve in the next six months against just 14% seeing worsening conditions. The survey also showed a decline in those expecting a recession, though still at 69.3% from the 73.2% in May.

—Jeff Cox

6 Hours Ago

New home sales rise more than expected in May

New home sales rose more than expected in May even as mortgage rates remain stubbornly high and buyers continue to fight a dearth of existing places to buy.

Sales surged to a seasonally adjusted 763,000 for the month, an increase of 12.2% from April and 20% from a year ago, the Commerce Department reported Tuesday. The Dow Jones estimate was for 675,000, or a decline of 1.2%.

Available homes for sale totaled 428,000, equating to 6.7 months of supply. Of the total sales,195,000 homes have not been started yet while 298,000 are under construction. The median sales price was $416,300, while the average price was $487,300.

— Samantha Subin, Jeff Cox

6 Hours Ago

Bank of America reiterates confidence in Disney’s ‘strategic path’

Bank of America is standing by Disney even as the company faces some hurdles.

“We remain confident that Disney has the proper mix of IP, content library/rights, brand value, park expansion opportunities and leadership to manage through the present challenging environment and position the company for future growth,” wrote analyst Jessica Ehrlich in a Tuesday note to client.

Even as the company faces a range of “strategic issues,” including a murky path to profitability in its direct-to-consumer business and an uncertain succession plan, Ehrlich remains confident in Disney.

She added that Disney’s “best-in-class premiere assets” and that CEO Bob Iger’s “strong track record and deep industry relationships will steer the company in the right direction.”

The analyst lowered third-quarter EPS estimates to reflect some challenges within content sales and licensing, but retained her $135 price target. The price objective suggests that shares, up 2% this year, could rally more than 52% from Monday’s close.

— Samantha Subin

[ad_2]

Source link